-

Key Takeaways

-

How Much Does Drone Insurance Cost?

- Factors Influencing Premiums

- Average Cost Estimates

-

Why Do You Need Drone Insurance?

- Drone News Update

- Mitigating Risks and Liabilities

- Protecting Your Investment

- Legal and Regulatory Requirements

- Client and Employer Expectations

-

Types of Drone Insurance Coverage

- What Insurance Is Needed for a Drone?

- Tips to Save on Drone Insurance Costs

-

How to Choose the Right Drone Insurance

- Assessing Your Specific Needs

- Understanding Coverage Options

- Comparing Insurance Providers

- Reading the Fine Print

-

Where to Buy Drone Insurance

- Specialized Drone Insurance Providers

- Traditional Insurance Companies

- Manufacturer Insurance Plans

- On-Demand Insurance Providers

- Insurance through Membership Organizations

-

Steps to Purchase Drone Insurance

- Determining the Appropriate Coverage

- Gathering Required Information

- Requesting and Comparing Quotes

- Finalizing the Policy

-

Filing a Drone Insurance Claim

- Immediate Steps After an Incident

- Notifying the Insurance Provider

- Understanding the Claims Process

- Tips for a Smooth Claims Experience

-

Case Studies: Drone Insurance in Action

- Case Study 1: Accidental Damage

- Case Study 2: Liability Claim

- Lessons Learned from Real-Life Incidents

-

Conclusion

After enough time flying, something will eventually go wrong. That’s why drone insurance matters.

In this case, it wasn’t a crash—it was theft. The door to the Airbnb was slightly ajar, and inside was a ransacked apartment. Most of the camera gear had been taken along that night, but the thieves discovered a not-so-clever hiding spot for the Mavic Pro.

Just like that, a few thousand dollars seemed gone for good, or so it seemed.

No matter how skilled you are as a pilot, real-world environments are unpredictable. Even a routine mission can turn into a disaster.

Fortunately, drone insurance offered a safety net when the unexpected happened.

Protect your investment, learn the facts about drone insurance, and safeguard your gear today.

Key Takeaways

● Why Drone Insurance Matters – Protect yourself from liability, theft, and equipment loss.

● Types of Coverage – Understand liability, hull, and payload insurance and what each covers.

● Cost and Savings – Learn how much drone insurance costs and ways to lower your premiums.

● Choosing a Policy – Find the best coverage based on legality and industry needs.

How Much Does Drone Insurance Cost?

| Factor | Details | Estimated Cost |

| Premium Range | Annual premiums vary widely based on coverage level, usage type, and flight environment. | $500 – $1,000+ per year |

| Liability Coverage | Covers damage or injury caused by the drone. Higher limits mean higher premiums. | $1M policy: $500–$1,000/yearor ~$55/month |

| Hull Insurance | Covers damage to your drone and attached equipment (e.g., cameras, gimbals). Usually priced as a % of drone value. | 8%–12% of drone/equipment cost |

| Flight Type | Commercial use often has higher premiums due to increased risk. Recreational flyers may get cheaper rates. | Commercial: HigherRecreational: Lower |

| Policy Length | On-demand, monthly, or annual plans available. Great flexibility for occasional flyers. | Hourly: From $10/hrAnnual: Discounted |

| Flight Environment | Flying in dense or urban areas increases liability risk, potentially raising premiums. | Urban: HigherRural: Lower |

| Provider Example | Skywatch.AI offers multiple plans (hourly, monthly, annual) with pause/resume options. |

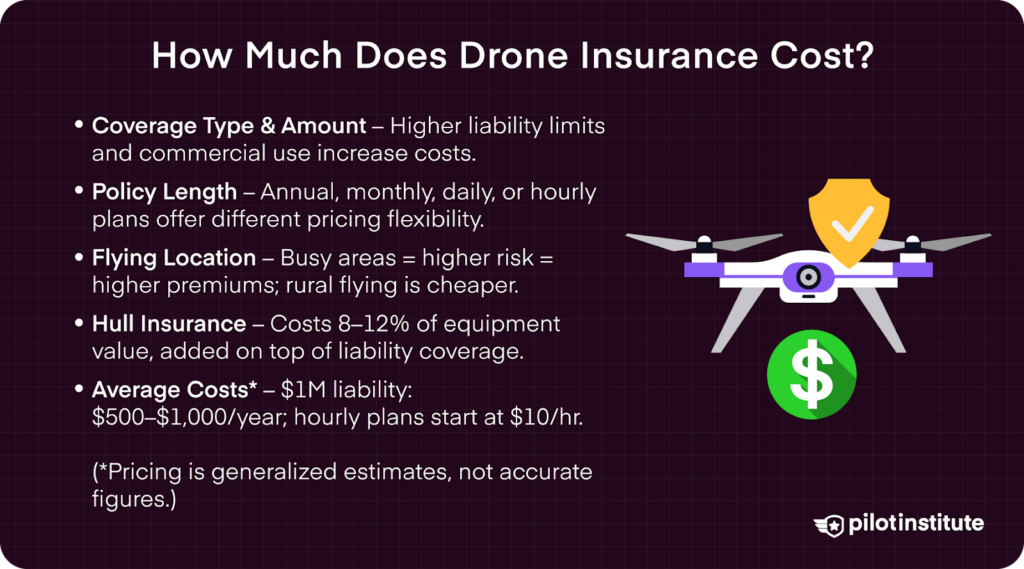

Factors Influencing Premiums

Not all premiums are alike, ranging from $500 to over $1,000 a year—a big difference.

Several factors can impact the cost of drone insurance premiums. Higher liability coverage obviously comes with a higher premium price tag.

Commercial flying also often comes at a higher price, as there is increased risk compared to recreational flying.

The length of plans also impacts price, with on-demand daily or hourly plans being much more affordable for recreational or occasional flyers who don’t need coverage during those in-between flight times.

Flying in busier, populated areas increases the risk of incidents, so pilots who fly in these environments may benefit from spending the extra money on higher liability coverage.

More recreational flyers who operate in less densely populated areas, however, can probably save here with lower policy coverage.

Average Cost Estimates

Liability Insurance Costs

Liability rates range drastically. On average, $1 million in liability insurance typically costs between $500 and $1,000 annually.

A $1 million liability coverage can be set on a monthly billing cycle with Skywatch.AI for $55 monthly.

You could save and pay upfront for an annual policy, but there are times you might not be flying and want the flexibility to pause your coverage as needed.

Hull Insurance Costs

Hull insurance is billed on top of liability coverage. Most companies will offer hull insurance from 8% to 12% of the cost of the insured equipment. Skywatch.AI averages around 10% for hull insurance and add-on equipment, such as gimbals or cameras.

On-Demand vs. Annual Policies

One thing that sets drone insurance apart is the flexibility of plans. Most companies offer variations in the length of policies, from annual or on-demand policies billed monthly, daily, or even hourly.

For example, Skywatch.AI has yearly and monthly plans, as well as hourly plans starting at $10 an hour. This gives pilots impressive flexibility in how to choose their coverage.

Hourly plans are also incredibly affordable for more infrequent flyers, who pay only when they know they will be in the air.

For more frequent flyers, annual plans make more financial sense. They often give discounts for buying longer policies.

Why Do You Need Drone Insurance?

The commercial use of drones has expanded rapidly, from photography to agriculture. Sales of UAVs in 2024 reached $6.58 billion. That number is expected to continue rising, with an estimated 16.9% growth rate over the next ten years.

Impressive advances in drone technology and manufacturing have made UAVs more cost-effective and accessible to industry professionals and recreational flyers alike. Over one million recreational operators fly alongside the Part 107 holders.

Hazards increase with so many drones in the air at any given time. Safety concerns, regulatory compliance, and potential liability in the event of an accident or privacy violation are all very real risks. Having the proper drone insurance is a key component in managing these risks.

Today, more pilots carry insurance—not because their clients require it—but because they want to insure themselves and protect their investments.

Marketing Manager at Skywatch.AI, Elad Shalev, told Miriam McNabb of DroneRacingLife.com:

“The fact that today more than a third choose to insure themselves, even when they don’t have to […] shows us not only that the industry is maturing, but also pilots have a higher appreciation for their gear and for the importance of insurance.”

Don’t wait until it’s too late–learn how drone insurance can protect you from unexpected losses.

Mitigating Risks and Liabilities

Common risks include accidents caused by technical failures or pilot errors. Losing GPS signal, battery or propeller failure, and software glitches can all lead to catastrophic crashes or your drone flying off into the void. Pilots can misjudge distances or bank a curve too hard. These things happen.

There is also the ever-changing threat of the weather. Not surprisingly, inclement weather causes nearly a quarter of all drone crashes.

High winds can drain batteries, drastically cutting the drone’s range. Even the slightest bit of precipitation can fry a drone.

Flying over water can confuse critical sensors, tricking the drone into thinking that the water is actually open sky.

Judging distances over water can also be difficult, leading to operator error that may result in your drone taking a dip in the ocean.

Risks increase exponentially when conducting operations near people. The FAA reminds us that “remote pilots and recreational flyers should carefully consider the hazards of flight operations over or near people” (AIM Chapter 11, Section 8). Even a minor accident resulting in injury can lead to significant financial consequences.

Protecting Your Investment

Drone insurance covers liability and physical damage, offering reimbursements and sometimes even replacements to protect your investment.

A tailored drone policy for your unique use case can cover repair or replacement costs, allowing you to fly with peace of mind.

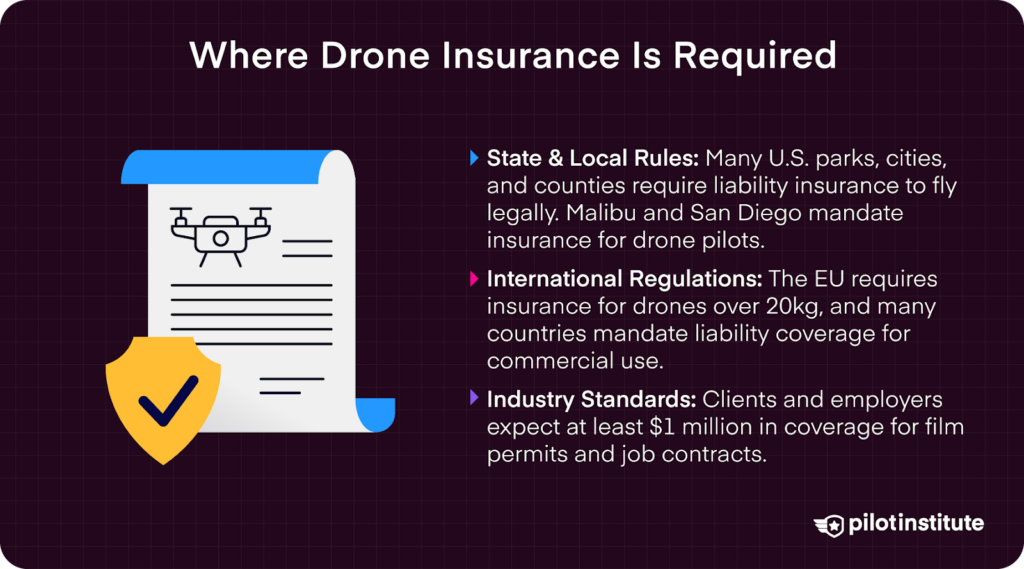

Legal and Regulatory Requirements

Is Drone Insurance Required by Law?

In the United States, no federally mandated law requires commercial or recreational pilots to carry drone insurance. There are, however, FAA regulations regarding drone operations that must always be adhered to.

For example, drones above 250 grams or operated under an FAA Part 107 Certification require registration with the FAA. According to AIM Chapter 11, Section 2, “failure to register a UAS that requires registration may result in regulatory and criminal penalties.”

Moreover, the FAA recently implemented its TRUST test program, which is now required for all flyers, even recreational ones.

State and Local Insurance Requirements

As of February 2025, the FAA reported:

- 977,847 TRUST certifications issued

- 385,892 recreational flyer registrations

A patchwork of state and local regulations demands more explicit insurance requirements. Many state parks, cities, and counties now require liability policies to fly in their jurisdiction.

In California, the City of Malibu and the County of San Diego mandate pilots to have liability insurance to minimize property damage.

Most areas of Malibu also even require drone operators to get a film permit, which requires commercial drone insurance, typically with liability coverage of $1 million or more.

International Drone Insurance Regulations

Many foreign countries also require drone insurance to operate within their territories. For instance, the European Union’s EASA (the European equivalent to the FAA) requires pilots with drones over 20kg to have mandatory insurance.

Many nations within the EU also independently require pilots to carry third-party liability insurance when operating commercially.

The EASA recommends that pilots check the National Aviation Authority websites of member states before traveling to ensure they meet all insurance requirements.

Drone Insurance Requirements in Thailand

Additionally, Thailand requires Thai drone insurance valid for two years to be approved by the Civil Aviation Authority of Thailand (CAAT).

Given that the situation in Thailand is quite difficult to navigate, many pilots traveling to Thailand will hire a drone registration service to register drones with the CAAT and NBTC to get through the bureaucracy and red tape.

Client and Employer Expectations

Many clients and employers expect liability insurance to cover their bases and thus pass the burden of carrying insurance onto the drone operator. Securing a film permit often also requires liability coverage, typically of a minimum of $1 million in coverage.

Overall, having the appropriate coverage when you walk onto a job site enhances professional credibility and reassures clients of your commitment to risk management.

So, if you’re looking to expand your drone business, having appropriate insurance will help open up more high-paying gigs and ensure smooth contract negotiations.

Types of Drone Insurance Coverage

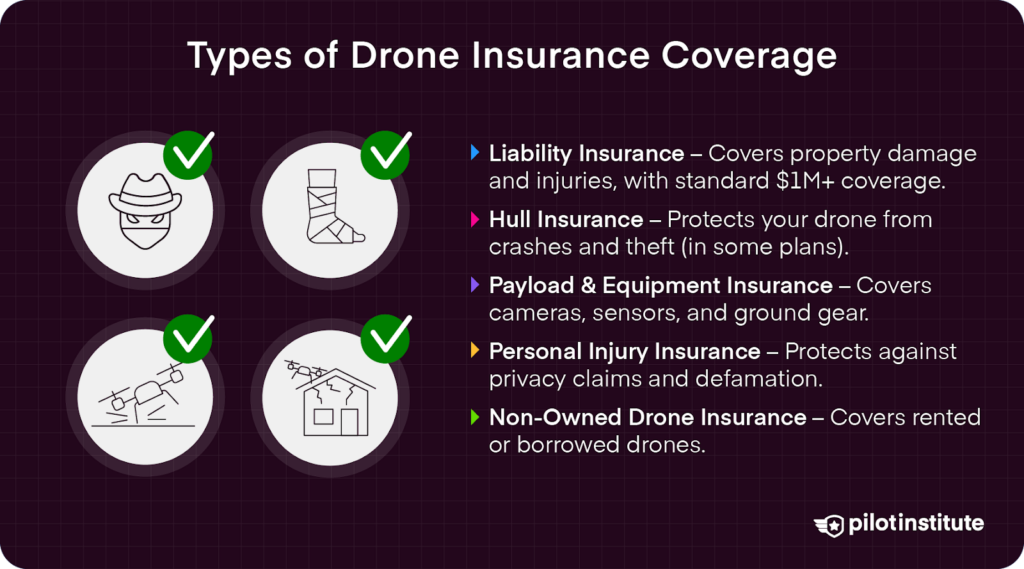

What Insurance Is Needed for a Drone?

Liability Insurance

Liability insurance protects against property damage and bodily injury in the event of an accident.

Very much like car insurance, liability policies protect pilots from claims initiated by third parties as a result of a flight incident. This is especially important given the potential damage drones can cause.

The Task A4 Ground Collision Severity and Task A11 Part 107 Waiver Study evaluated the severity of injuries caused by UAV collisions.

Reviewing hundreds of impact tests, the study found that high-speed drone impacts on a human body can result in concussion and in more extreme cases, skull fracture and other skeletal injuries.

If someone is injured during flight operations, it is important to have liability coverage so you’re not stuck footing the bill.

Third-party liability policies offer a protective shield of coverage starting around $500,000, but the industry standard is $1 million.

Skywatch.AI and Global Aerospace’s policies also even offer $5,000 to cover bail bonds if things get that serious.

Hull Insurance

Physical Damage Coverage

Hull coverage offers done body protection from damage incurred in crashes or other situations. Nu Sure Insurance describes hull coverage as “the backbone of drone insurance.”

It covers repairs and replacements of the physical components of your UAS, reducing your out-of-pocket expenses. While hull insurance is often not required as much as liability insurance is, it is still critical, in my opinion.

Today, more pilots are spending the extra cash to add hull insurance to their plans. In 2022, over a third of drone insurance was purchased to cover hull protection.

Yet, not all hull policies cover additional equipment attached to the drone, such as cameras or gimbals. So, it is important to check policy details to get the hull policy tailored for your use applications.

Coverage for Theft and Loss

Many popular hull plans even cover theft. Insurance will help you replace your drone and keep you working when a total loss occurs because of theft. This is something that every drone operator should be concerned about.

Just a quick word to the wise: Skywatch.AI recently reported that the majority of theft claims involve a drone stolen from an unattended vehicle, so make sure not to leave yourself unnecessarily vulnerable.

Payload Insurance

Payload insurance essentially covers anything attached or carried by a drone. This includes specialized equipment attached to the drone, such as sensors, cameras, or other payloads, making it a must-have when working with more expensive camera equipment, such as a thermal or multispectral camera.

Drone operations engaged in aerial photography, surveying, or agricultural monitoring often feature expensive equipment not included in standard hull insurance.

Payload insurance is also critical for anyone operating in logistics and deliveries, one of the fastest-growing drone industries.

Ground Equipment Insurance

Ground equipment insurance covers all the equipment you need to safely fly your drone. That means remote controls, base stations, and even laptops or cell phones that assist in flight operations.

Protecting all components of your operation ensures continuity and helps stave off unexpected expenses.

After all, pilots have to keep a line of sight to their drones in flight, so they may not be super dialed into watching their equipment on the ground. Avoid financial loss if something is stolen or damaged while safely operating your drone.

Given the necessity of this type of equipment, insurance companies like Skywatch.AI offer equipment add-ons to enhance protection on land and in the skies.

If your preferred insurer does not offer ground equipment policies, there are third-party gear insurance companies that can pick up any extra slack.

In California, Athos Insurance Services provides impressive annual and short-term plans for gear used on the ground, like laptops and other equipment used in aerial videography.

Personal Injury Insurance

To augment liability insurance, personal injury insurance covers damages associated with libel, slander, and, most importantly—invasion of privacy.

So, if you’re out flying one sunny day and accidentally capture potentially disturbing or embarrassing images without consent, personal injury insurance has you covered.

This is especially important in states like California, which have strict privacy protections aimed at drone flights. As more local and state governments increase their privacy regulations, it will be critical to have this type of protection.

Non-Owned Drone Insurance

Many commercial pilots fly rented equipment or their customers’ equipment. Non-owned drone insurance will protect rented or borrowed equipment, insuring this equipment as if it were part of your arsenal. This coverage is often offered for short intervals, such as by the day or hour.

Tips to Save on Drone Insurance Costs

Fly Safely to Lower Premiums

One of the most obvious tips to save money on drone insurance policies is simply to fly safely. Fewer incidents claimed on insurance result in a lower insurance premium. Following best practices and keeping a solid flight record can also help keep premiums low.

Get Certified to Reduce Risk Perception

Additionally, completing training or certification programs can also demonstrate proficiency and reduce the perception of risk.

For commercial pilots, FAA Part 107 Certification can prove competence, as it offers information on regulations in the U.S., the effects of weather, maintenance, and preflight inspection procedures, operating at night, emergency procedures, and more.

Even if you fly recreationally, you can undergo training like the FAA’s TRUST Test.

Consider International and Additional Certifications

Certifications from other countries, such as the EU’s EASA A1/A3 Open Sub Category Certification, also work to prove proficiency and adherence to safety procedures.

Bundle Coverage for More Savings

Bundling coverage can also add savings. Combining liability with hull insurance, for example, is a way to keep costs lower than just liability alone.

Add Equipment Independently to Reduce Deductibles

In addition to bundling coverages, adding equipment independently to your policy can also save in the long run.

Skywatch.AI advises adding equipment to your existing policy using their easy user interface. You can choose to add on equipment such as cameras, sensors, carry, landing pods, spare parts, gimbals, controllers, and even batteries—anything directly related to the operation of the drone.

Adding these additional components independently reduces the deductible you would have to pay when making a claim for specific components.

For example, you can add your gimbal, camera, controller, and batteries, so if you have trouble with any of these systems, the deductible is significantly less, about 10% of the value of the piece of equipment, rather than the entire cost of the drone.

Shop Around for the Best Insurance

It is also smart to simply shop around. Call different insurance companies for quotes and see who offers the best insurance plans for your needs at the most competitive price points.

How to Choose the Right Drone Insurance

Assessing Your Specific Needs

Before picking a policy, it’s crucial to evaluate the unique needs of your operations. Consider flight frequency, mission types, potential payloads, and operating environments.

Infrequent flyers who fly recreationally in open, sparsely populated environments don’t need certain coverage.

Commercial flyers who often fly in dense urban environments, harsh environments, or with expensive payloads, however, need much more robust coverage.

When thinking about your needs, focus on what risks you may encounter during a typical day flying for you.

Understanding Coverage Options

Many companies offer option add-ons to help tailor your policy specifically to your use case. This can be additional payload or personal injury insurance.

Still, it can also include specific equipment used in drone operations to ensure everything is accounted for if you have to file a claim.

Comparing Insurance Providers

It is always important to compare providers, but not just on policy terms. Choose a company with a strong reputation, financial stability, and consumer reputation over a new company offering cheap policies.

Check Google Reviews, Better Business Bureau, and forums such as MavicPilots.com or Commercial Drone Pilots Forum.

Reading the Fine Print

There are often major differences in policy limits, deductibles, and what equipment is covered from policy to policy. Some common exclusions in typical coverage include mechanical or technical failures and wear and tear.

Overestimating your policy will only bite you later when you try to make a claim.

Where to Buy Drone Insurance

Specialized Drone Insurance Providers

SkyWatch.AI

Skywatch.AI has been an industry leader since it was founded in 2016. Their customizable policies ensure you build a policy tailored to your unique needs.

Not only do they offer policies covering hourly, monthly, and yearly terms, but they also have different tier plans depending on your fleet size and any additional equipment you need in drone flight operations.

Its app and user interface are easy to use when researching policies, getting quotes, and filing claims. The app also offers quick access to your certificate of insurance (COI).

Skywatch.AI is highly recommended because of its network of reliable insurers, expertise, ease of use, and impressive customer service.

BWI | Fly

BWI | Fly is a powerhouse in the aviation industry. By leveraging its larger aviation insurance operations, BWI brings impressive aviation insurers to the world of UAV insurance.

While price points start as low as $475 annually, the company offers incredibly diverse liability policy options, from $500,000 up to $25 million. Thus, this is a great option for commercial pilots working in high-risk applications.

BMI also offers hull insurance and does not charge for additional COIs, which is great for larger companies working with numerous pilots and UAVs.

Traditional Insurance Companies

State Farm

State Farm also offers drone coverage in their Personal Articles Policy for accidental damage, theft, and total loss.

Unlike traditional aviation insurance, State Farm’s policies are primarily designed for recreational drone operators. The PAP policy only offers hull coverage, without options for liability.

Still, this is a great and affordable option, with plans starting as low as $60 annually for around $2,000 of coverage without deductible requirements.

Global Aerospace

Global Aerospace offers specialized drone insurance tailored for commercial flyers, offering liability coverage, hull protection, and policies protecting payloads and external equipment.

As a leader in the larger aviation insurance industry, their plans are backed by impressive aviation insurers.

Like Skywatch.AI, their policies are quite flexible, allowing you to customize coverage based on operational needs, including options for both single-flight and annual plans.

Along with third-party liability coverage, Global Aerospace also provides add-on hull and personal injury insurance.

Their policies even offer $100,000 in fire damage liability and coverage for hijacking incidents.

Yet, Global Aerospace has some of the highest price points in the industry.

Manufacturer Insurance Plans

DJI Care Refresh

DJI Care Refresh offers comprehensive protection for its products. Coverage includes accidental damage caused by collisions, water, signal interference issues, and natural wear and tear.

The program offers up to two replacement drones within the coverage period, which are sold in one or two-year intervals, ranging, typically from $109 to $589 depending on the product and term length.

Replacement fees vary depending on your drone but are reasonable considering the alternative of paying for one out-of-pocket.

All you need to do is send your drone to a DJI Service Center and wait for it to be repaired or replaced, making it a great option for hull protection for DJI drone owners.

On-Demand Insurance Providers

AirModo

AirModo provides on-demand drone insurance designed for pilots who fly less frequently. Hourly policies start at only $9 an hour.

With its easy-to-use app, AirModo also promises immediate COIs, making it easy when you’re on the go.

Its flexible coverage options and pay-as-you-go model make it perfect for recreational flyers who need liability and hull insurance only when needed.

Insurance through Membership Organizations

Academy of Model Aeronautics (AMA)

AMA members receive certain drone insurance benefits as part of their membership, which is $85 annually.

Membership alone is quite valuable for drone operators, providing access to impressive resources, such as training classes and community support.

The organization offers $500,000, $1 million, and $2 million aviation liability insurance coverage. AMA also offers $250,000 in personal injury coverage, along with hull coverage up to $20,000.

Professional Photographers of America (PPA)

PPA is known for its insurance plans covering cameras and other electronic equipment used in photography but now offers drone insurance to members. Annual membership runs $320.

The PhotoCare Plus plan offers drone insurance of up to $100,000 in liability coverage. Moreover, the Drones General Liability Coverage plan starts at $25,000 to $50,000 in liability coverage for members operating in a commercial capacity with a Part 107 license.

However, the coverage that comes with the membership does not include hull or payload insurance. PPA offers these as add-ons for an additional fee.

Steps to Purchase Drone Insurance

Determining the Appropriate Coverage

First, evaluate what operational risks you may encounter in your typical flight routines. Where are you flying most? How long? Are you flying outside and inside? Will you be carrying payloads? In more extreme environments? Near public places or large crowds? Are you flying your own equipment or your clients’ equipment?

After you are well aware of your specific use needs, you can best choose the necessary coverage types, such as liability, hull, or payload options.

Gathering Required Information

It is critical to first assess the value of your UAS, not only the drone but the whole system. Know where the serial number is for all your equipment, including the drone itself and any auxiliary equipment, such as controllers or batteries.

Have your receipts on hand for the exact market price, as well as a list of additional payload or attached equipment that may need to be included in coverage. A simple Google search can help you estimate current market prices for such add-ons.

Gather all your certifications and any experience records as well. Proving competency and safe flying habits can help secure better premium prices.

If you hold a Part 107 Certification, know what types of clients and scenarios you will be working with.

Requesting and Comparing Quotes

Then, the research starts. Do not just look at one policy option from a single company. It is always advisable to obtain quotes from multiple insurance providers and compare coverage options.

Companies offering on-demand insurance policies, like Skywatch.AI, give unique, tailored quotes depending on your use case scenario. Call or email them to ask detailed questions so you know where you stand.

Thanks to many insurance companies having easy-to-navigate apps, prospective pilots do not even have to speak to a live agent to get a quote. For hourly insurance plans, pilots are free to plug in their flight location or other planning details to receive tailored quotes based on the mission details of the planned flight.

Finalizing the Policy

Before signing anything, review the policy offerings—including all the fine print. Pay close attention not only to policy coverage, but also to policy validity periods, renewal terms, and any cancellation fees to avoid unanticipated gaps in coverage that could keep you grounded.

Once the policy is finalized, make sure you get certificates of insurance (COIs) to show clients, organizers, or regulatory authorities while out in the field.

Filing a Drone Insurance Claim

Immediate Steps After an Incident

In the event an incident happens, it is important to act quickly. First and foremost, secure the area and check for injuries or potential damage.

Once you know things are under control, begin documenting by taking photos and videos and collecting witness statements if applicable.

These will prove critical during the claim process and will give you leverage if your insurer challenges the claim, providing for a much smoother resolution overall.

Notifying the Insurance Provider

Next, notify your insurance provider. Begin the process promptly, as some policies may have time limits on claims.

Providing your insurer with all the evidence you so laboriously collected will help speed up the process and ensure a better resolution.

Be open and honest with your insurance provider, as this will also help smooth out the claim process and avoid any potential delays or challenges.

Understanding the Claims Process

After you submit everything, the insurer will begin their investigation, reviewing the claim and evaluating any damage or liability. They may come back with some requests for additional information. Try to respond promptly to keep the pace moving.

The drone body and any additional equipment may need to be sent in for evaluation or to get an estimate for repair or replacement. If everything looks legitimate, approval for claims results in a payout or schedule for repair.

This process is unique to each situation and will vary greatly in the time it takes to complete. For simpler claims, one can expect a turnaround of around a week to 10 days if a claim is filed diligently and with all the proper documentation.

More complex claims, often involving injuries or property damage under liability policies, may take longer, sometimes up to several weeks or even months. Be patient and prompt in responding to any inquiries to speed up the process.

Tips for a Smooth Claims Experience

There are proactive steps pilots can take to help make claims experiences smoother. The best thing you can do is simply fly safely. Follow all regulations and safe practices guidelines recommended by the FAA and local authorities.

Additionally, keep in mind your policy details. Knowing the limitations of your policies helps you avoid getting stuck in situations where you aren’t covered.

Maintaining accurate flight logs and maintenance records can also help support your claim. These logs should contain information like date, time, GPS coordinates, UAS information, pilot details, flight time, and length.

Did you lapse a bit on flight logs? Don’t stress; you can access your flight log directly from many drone manufacturers. For example, DJI drones automatically record flight logs for each drone attached to your DJI Fly account.

Download DJI Assistant 2 (Consumer Drone Series) software and connect your drone to your computer using a USB cable, following the steps to download log data to your computer.

You can also check on battery health and charging data directly from the DJI Fly app. In the top right corner, click on the three-dot icon, then click “Safety” and “Battery Info” to display battery details such as current health and charge cycles.

After an incident, be prompt and organized when responding to questions from your insurer. Make it easy to deal with you to keep the pace moving nicely.

Case Studies: Drone Insurance in Action

Case Study 1: Accidental Damage

● Scenario: A professional drone pilot experiences a crash during a commercial shoot due to sudden weather changes, causing significant damage to the drone.

● Outcome: Since the pilot had hull insurance, the policy covered the repair costs, allowing the pilot to get back to work quickly, minimizing downtime and financial loss.

Hull insurance is critical in these situations. While no one was injured or property damaged, the pilot could have been grounded and out thousands of dollars if he did not have a hull policy protecting his equipment.

Case Study 2: Liability Claim

● Scenario: During a public event, a drone malfunctions and causes property damage by crashing into a vendor’s booth.

● Outcome: The pilot’s liability insurance covered the damages and legal fees associated with the claim, preventing personal financial liability.

Here, liability is essential for working around other businesses or crowds. This pilot can rest easy knowing that the cost of repairing the vendor’s booth will not have to come out-of-pocket.

Lessons Learned from Real-Life Incidents

These experiences are a clear example of why hull insurance is so important for drone pilots, especially those who are traveling aerial videographers. Though drone theft does not cause any damage or injury, it does leave you with a complete loss.

Without a comprehensive policy that includes hull coverage, you might have to replace your UAS completely out-of-pocket.

Learn vicariously through other pilots who have had similar situations—get adequate insurance tailored to your unique use needs before disaster strikes.

Conclusion

Drone insurance is critical for protecting your investments, complying with legal requirements, and confidently operating your drone.

Securing the appropriate drone insurance requires pilots to do their due diligence, researching and comparing different companies and plan options.

First, understand your equipment value and your typical operations. Then, get quotes and compare the best options. Read the fine print to ensure the policy fits your needs exactly so you are not left uncovered.

Assess your drone insurance needs carefully and take proactive steps to secure the best coverage that aligns with your typical operations and the potential risks involved.

Document incidents thoroughly and be prompt in your response to insurers to keep the pace of claims moving steadily.

With the right insurance, you can fly with complete competence, adequately prepared for any unexpected challenge.